Calculate loan payment student delves into the intricacies of student loan repayment, empowering students with the knowledge to make informed financial decisions. This comprehensive guide navigates the complexities of student loans, providing a clear understanding of the factors that influence monthly payments and offering strategies for managing debt effectively.

The content of the second paragraph that provides descriptive and clear information about the topic

Understanding Loan Payment for Students

Student loan payments are a major financial obligation for many students. It’s important to understand how student loans work and how to manage them effectively to avoid unnecessary financial burdens.

Types of Student Loans

There are two main types of student loans: federal and private. Federal student loans are provided by the government and offer several benefits, such as lower interest rates, flexible repayment options, and loan forgiveness programs. Private student loans are provided by banks and other private lenders and typically have higher interest rates and fewer repayment options.

Loan Terms and Interest Rates

Student loans typically have a term of 10 to 25 years, with interest rates varying depending on the type of loan and the lender. Federal student loans have fixed interest rates, while private student loans may have variable interest rates that can fluctuate over time.

For example, federal student loans for undergraduate students currently have a fixed interest rate of 4.99%, while private student loans may have variable interest rates that range from 3% to 12%.

Calculating Loan Payments

Determining the monthly payments for a student loan involves understanding the loan amount, interest rate, and loan term. The formula used to calculate loan payments is:

Monthly Payment = (Loan Amount

- Interest Rate) / (1

- (1 + Interest Rate)^(-Loan Term))

To illustrate the calculation process, consider the following table:

| Loan Amount | Interest Rate | Loan Term (Years) | Monthly Payment |

|---|---|---|---|

| $10,000 | 5% | 10 | $119.35 |

| $20,000 | 6% | 15 | $172.87 |

| $30,000 | 7% | 20 | $238.73 |

Factors Affecting Loan Payments

Understanding the factors that influence loan payments is crucial for students planning to finance their education. These elements determine the monthly payment amount, which can significantly impact a student’s budget.

Loan Amount

The loan amount, also known as the principal, directly affects the monthly payment. A higher loan amount leads to a higher monthly payment, as the borrower is repaying a larger sum of money.

Interest Rate

The interest rate, expressed as a percentage, represents the cost of borrowing money. A higher interest rate results in a higher monthly payment, as more of the payment goes towards interest charges.

Loan Term

The loan term, or repayment period, influences the monthly payment. A shorter loan term, such as 10 years, leads to a higher monthly payment compared to a longer term, such as 20 years. This is because the total interest paid over a shorter period is less than over a longer period.

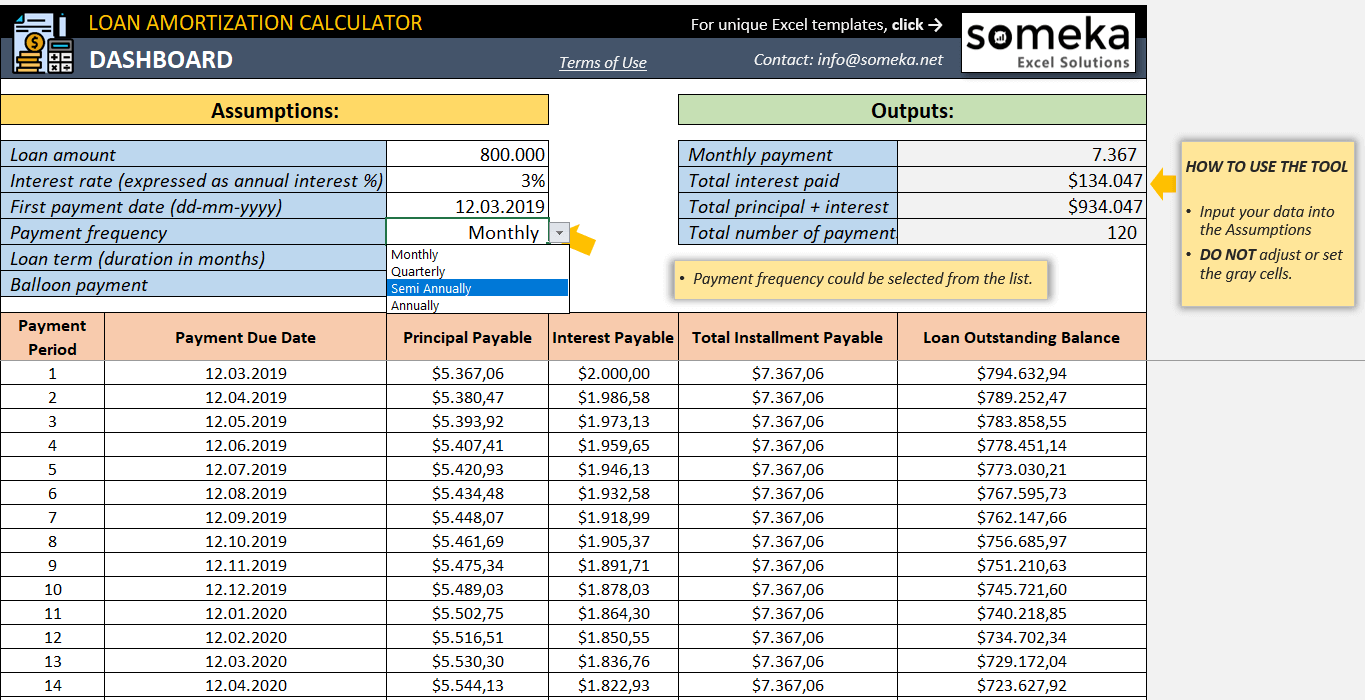

Students seeking financial assistance for their education can utilize online tools to calculate loan payment student obligations. These calculators provide insights into monthly payments, interest rates, and loan terms. By inputting relevant information, students can make informed decisions about their borrowing capacity and develop a repayment plan that aligns with their financial goals.

| Factor | Impact on Monthly Payment |

|---|---|

| Loan Amount | Higher loan amount = higher monthly payment |

| Interest Rate | Higher interest rate = higher monthly payment |

| Loan Term | Shorter loan term = higher monthly payment |

Additional Considerations: Calculate Loan Payment Student

When calculating loan payments, it’s crucial to consider additional factors beyond the principal and interest. These factors can significantly impact the overall cost of borrowing and repayment plan.

Understanding the total cost of borrowing is essential for informed decision-making. This includes considering not only the loan amount but also fees, insurance, and other expenses associated with the loan.

For students seeking higher education, calculating loan payments is crucial for financial planning. The calculate loan payment student tool offers a comprehensive analysis of monthly payments, interest rates, and loan terms. By inputting relevant information, students can estimate the total cost of their education and make informed decisions about borrowing.

Fees and Insurance

- Origination fees:One-time charges for processing and underwriting the loan.

- Closing costs:Expenses related to finalizing the loan, such as title search, appraisal, and legal fees.

- Loan insurance:Protection for the lender in case of default, typically required for higher-risk borrowers.

- Credit life insurance:Coverage that pays off the loan in case of the borrower’s death.

- Disability insurance:Coverage that makes loan payments in case of the borrower’s disability.

Minimizing Loan Payments, Calculate loan payment student

- Shop around for the best rates:Compare offers from multiple lenders to secure the lowest interest rate.

- Consider a shorter loan term:While this will increase monthly payments, it can save money on interest over the life of the loan.

- Make extra payments:Even small additional payments can reduce the principal faster and lower the total interest paid.

- Refinance the loan:If interest rates drop or your credit score improves, refinancing to a lower rate can save money.

Managing Debt Effectively

- Create a budget:Track income and expenses to ensure loan payments are manageable.

- Prioritize debt repayment:Focus on paying off high-interest debts first to minimize overall interest charges.

- Seek professional help:If managing debt becomes overwhelming, consider consulting a credit counselor or financial advisor for guidance.

Conclusive Thoughts

In conclusion, calculating loan payments for students is a crucial step towards financial literacy. By understanding the factors that affect monthly payments and implementing effective debt management strategies, students can navigate the repayment process with confidence, minimizing costs and maximizing their financial well-being.

FAQ

What is the formula for calculating loan payments?

The formula for calculating loan payments is: Monthly Payment = (Loan Amount x Interest Rate) / (1 – (1 + Interest Rate)^(-Number of Payments))

How does the loan amount affect monthly payments?

The higher the loan amount, the higher the monthly payments.

How does the interest rate affect monthly payments?

The higher the interest rate, the higher the monthly payments.